We shape the future of cybersecurity

Cyberrisks have increased for the financial sector. Cyberincidents that damage the reputation of the Swiss financial sector or have the potential to result in a severe financial crisis are an ever-increasing threat. Close cooperation between financial institutions and authorities is thus crucial to identifying and combating cyberrisks.

The Swiss Financial Sector Cyber Security Centre (Swiss FS-CSC) reinforces the financial sector’s ability to withstand these risks – its cyber resilience and strengthens and promotes partnership between financial institutions and authorities on strategic and operational issues.

The association Swiss Financial Sector Cyber Security Center (Swiss FS-CSC) was founded on April 5, 2022 in Zurich. Founded in Zurich on 5 April 2022, the association has 55 founding members, including banks, insurers and industry associations – among them the Swiss Bankers Association (SBA), SIX, the Swiss National Bank (SNB), the Swiss Insurance Association (SIA) and the Association of Foreign Banks in Switzerland (AFBS). The Swiss Financial Market Supervisory Authority FINMA, the National Cyber Security Centre (NCSC) and the State Secretariat for International Finance (SIF) support it as affiliates. The Swiss Financial Market Supervisory Authority FINMA, the National Cyber Security Center (NCSC) and the State Secretariat for International Finance (SIF) provide support as affiliates.

Association board

August Benz

President

Alexandra Arni

Vice President

Marc Cortesi

Treasurer

Gabor Jaimes

Board member

Business Office

Alexandra Arni

Executive Officer

Corinna Eschbach

Legal Counsel & Association Manager

Bodo Grütter

Dipl. business informatics specialist

Salome Tscheulin

Office Manager

Isabelle Pryce

Communications & Media Manager

Noah Denger

Cyber Security Analyst

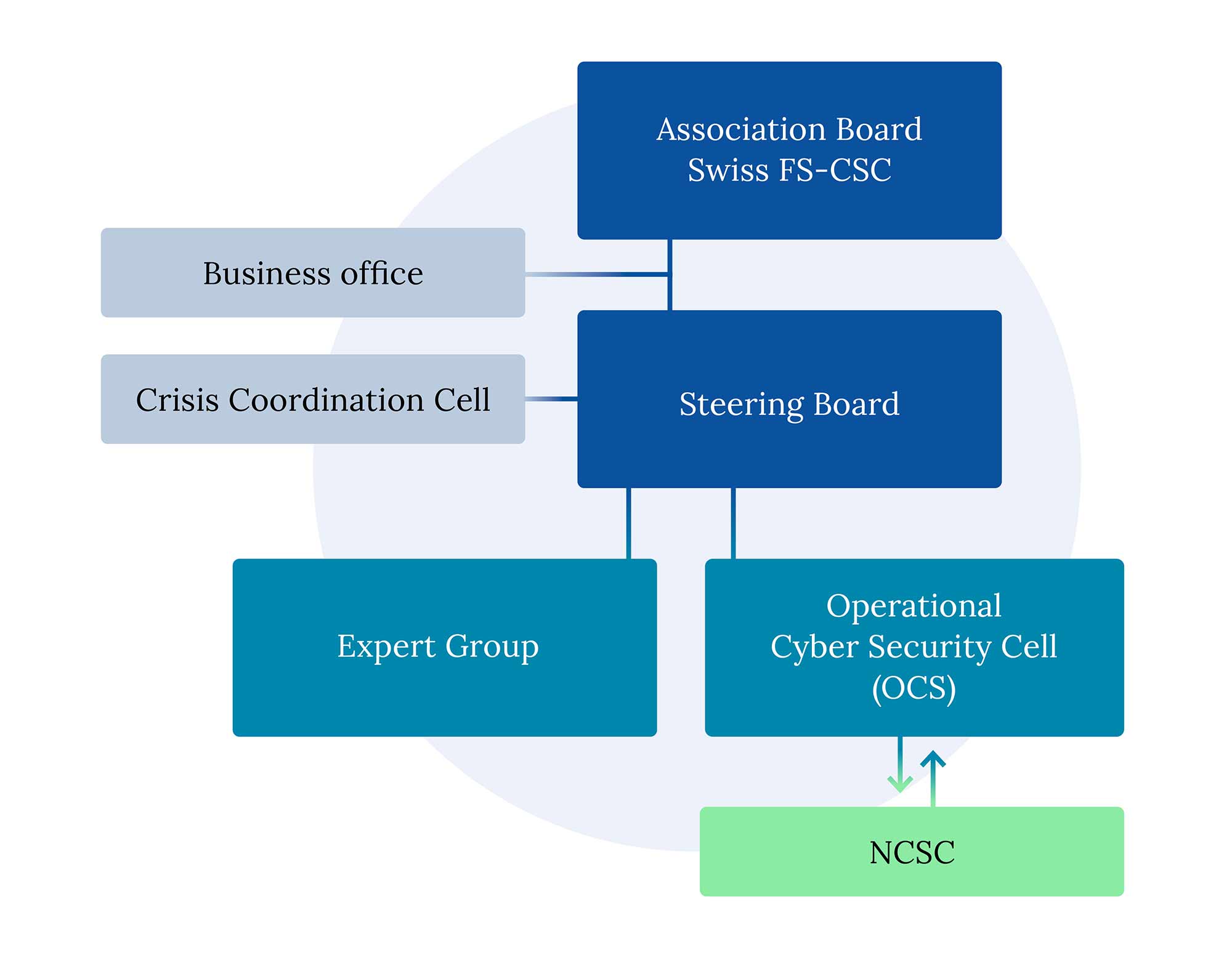

Organisation chart

Steering board

The Steering Board, which currently has around 20 members, is responsible for the association’s strategic management. In addition to the companies Baloise, Helvetia, Mobiliar, PostFinance, Raiffeisen, SIX Group, Swiss Life, UBS and Zürcher Kantonalbank, the National Cyber Security Centre (NCSC), the State Secretariat for International Finance (SIF), the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss National Bank (SNB) also have a seat in the Steering Board. Moreover, the Swiss Bankers Association (SBA), the Swiss Insurance Association (SVV), the Association of Foreign Banks in Switzerland (AFBS), the Association of Swiss Cantonal Banks (VSKB), the Association of Swiss Asset Management and Wealth Management Banks (VAV), the Association of Swiss Private Banks (ABPS) and the Association of Swiss Regional Banks (VSRB) sit in this body.

Association board

The Association Board consists of four elected members: President August Benz, Vice President Alexandra Arni, Treasurer Marc Etienne Cortesi and Gabor Jaimes. The Board’s tasks include the organizational and financial management of the association and the admission and exclusion of members as well as the election of the executive director (establishment of the executive office).

Business Office

The Business Office is headed by Alexandra Arni as Executive Officer.

Operational Cyber Security Cell (OCS)

The Operational Cyber Security Cell (OCS) has an extensive international network and is responsible for cyber intelligence. It monitors the situation and continually updates Swiss FS-CSC members on current and potential cyber threats that could impact financial services.

Expert Group

The expert group advises the other bodies and is divided into so-called chapters. It comprises around 70 representatives from both member organizations and affiliates.

7 Chapters

Risk Management

Risk Management

Assessing systemic vulnerabilities and updating risk analysis.

Regulation und Compliance

Monitoring and evaluating new regulations related to cybersecurity issues.

Relationship Management and Organizational development

Maintaining relationships with members and partners; managing the quality review process of OCS activities

Exercises and Training

Planning and conducting crisis exercises and training for Swiss FS-CSC members and affiliates

Technology and Innovation

Monitoring and evaluating new security technologies and services relevant to in- creasing cyberresilience in the financial sector

Crisis Management Support

Developing standardized procedures and providing ad-hoc support in crisis situations

Operational Excellence

Optimizing information exchange and communication channels between the OCS, NCSC and the financial sector.

Statutes of the association

Version 04.06.2025